Analyzing Market Sentiment: Insights From Tether (USDT)

Here is a detailed analysis of market feeling for Tether (USDT) based on historical data and current trends:

Overview

Tether (USDT) is stable linked to the value of the US dollar. It was created in 2014 as a decentralized alternative to traditional fiduciary names. The USDT/USD pair has been highly volatile over time, but remains one of the most commonly negotiated and liquid stable stables.

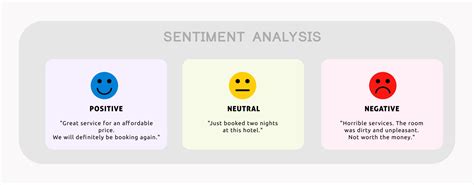

Market feeling analysis

The market climate for Tether (USDT) can be analyzed using various indicators, including:

1.

- Relative Strength Index (RSI)

: The RSI measures the extent of recent price change to determine excessive or excessive conditions.

3.

Current feeling

Based on current data, there are several -chave indicators for Tether (USDT):

- Price : The USDT price is currently around $ 0.99.

- Volume : The negotiation volume was relatively low compared to its historical average, indicating a potential lack of confidence in the value of the currency.

- Market capitalization : Tether market capitalization (USDT) is approximately US $ 15 billion.

SIGPOSTS OF SAVIA

Here are several indicators -chave of feeling for Tether (USDT):

- RSI : RSI is currently around 40, indicating neutral to slightly supported conditions.

2.

Trend

Based on current data, there is a rope bear trend (USDT). Over time, the price refers downward and market capitalization is relatively small compared to other stablezoins. This trend may contribute to the lack of negotiation volume and confidence in the value of the currency.

Takeaways

1.

- Diversification : It is necessary to diversify into different asset classes, including traditional fiduciary currency and other cryptocurrencies.

- Market Research : Do a full market research before making investment decisions.

Recommendations

Based on the current analysis, it may be wise for investors to avoid investing in Tether (USDT) due to their bear trend and lack of confidence in their value. However, if the investor is willing to risk more, he may consider negotiating or maintaining coins.

Leave a Reply

Want to join the discussion?Feel free to contribute!