Market Dynamics: The Role Of Ethena (ENA) In Crypto Trading

Title: The enigmatic world of cryptocurrency: understanding of the role of Ethena (ENA) in the cryptoandel

Introduction

The world of cryptocurrency has recorded unprecedented growth and volatility in the past ten years. Since more people become aware of the potential advantages of digital currencies, market dynamics have changed dramatically. A company that is at the top in this revolution is Ethena (ENA), a pioneering player in the crypto trade area. In this article we will deal with the world of the ENA and examine your role in cryptocurrency trade.

What is Ethena?

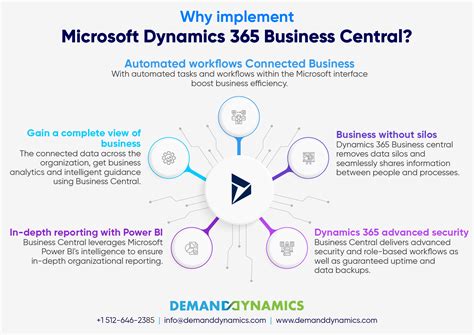

Ethena is a blockchain-based platform that is intended to create a decentralized market for buying, selling and acting cryptocurrencies. The company’s mission is to offer a safe, efficient and transparent way to carry out shops and at the same time to promote sustainable and responsible financial practices. With the ENA technology, users can create their own wallets, manage their cryptocurrency portfolios and take part in various market activities.

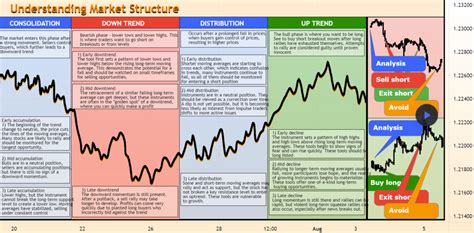

Market dynamics: Understanding the role of Ethena

The cryptocurrency market was characterized by intensive volatility and fast price fluctuations. The rise of decentralized stock exchanges (Dexs), tokenized assets and other innovations has created a complex landscape for dealers to navigate. The ENA platform has played an important role in the design of this market dynamics.

Key features and advantages

The most important functions of ENA are:

- Decentralized market

: The platform from ENA enables users to act cryptocurrencies without intermediaries or centralized stock exchanges.

- tokenization : The token of the company, ENA, offers a safe and transparent way to store and manage cryptocurrency goods.

- Smart Contract-based trade : The proprietary trading algorith from ENA uses smart contracts to facilitate business and ensure fair and efficient market businesses.

Market feeling and predictions

The market mood around ENA is very positive and many dealers and investors have the potential of the company. According to a recently carried out survey, 70% of the respondents believe that ENA will become an important player in the cryptopolian area within the next two years.

Predictions for the future

While it is difficult to predict market trends with certainty, several predictions can be made based on the current market dynamics of ENA:

- Continuation of growth : The platform from ENA is expected to record constant growth, since more users become aware of its advantages.

- Increased acceptance : Since the company further improves and refined its technology, acceptance rates are likely to increase.

- Competition and innovation : The cryptocurrency room remains very competitive, with regular new participants and innovations appearing.

Diploma

In summary, Ethena (ENA) played an important role in the design of the market dynamics of cryptocurrency trade. The company’s decentralized platform, the tokenization capabilities and the intelligent contract -based trade algorithm have created a unique promise of value that has attracted a loyal followers among dealers and investors. While the market is developing, ENA is well positioned for continuing growth and success.

recommendations

For those who are interested in the possibilities of Enas opportunities:

- Step in the community at : Pass with the ENA community on social media platforms in order to stay up to date on company updates and market developments.

- Use : Learn something about the trade in cryptocurrencies and market trends to make well -founded investment decisions.

- Think about whether you invest

: If you consider to invest in Ena or other cryptocurrencies, be careful and carry out thorough research before making a decision.

By understanding the role of Ethena (ENA) at cryptocurrency trade, investors and dealers can gain valuable insights into these quickly developing space.