Ethereum: Why doesn’t the number of shares in my miner match the number of shares reported by my pool?

The Elusive Share Count: Understanding the Ethereum Pool discrepancy

As an avid Ethereum user and miner, it’s natural to expect that when you find a share, your block will be recognized by the network and reflected in the blockchain. However, for some miners, this doesn’t always happen as expected. A common issue is the mismatch between the number of shares found on the local mining rig and the reported share count in the Ethereum pool.

Why Does it Happen?

Several factors contribute to this discrepancy:

- Network congestion: When many miners are competing for blocks, the network becomes congested, leading to delays in verification processes. This can result in a delay in reporting shares found on the local rig.

- Verification times: The Ethereum blockchain is designed with a slow verification process (60 minutes). During this time, miners may not be aware of the share they’ve found until the block has been verified by other nodes.

- Pool rebalancing: As new blocks are mined and added to the pool, existing shares may need to be rebalanced to maintain a fair distribution of rewards. This process can sometimes lead to discrepancies between local mining rigs and the reported share count.

When Does it Happen?

This issue is more common when:

- Miners have slow verification times: If your local rig has slow verification times, it may take longer for shares to be verified and reported.

- Pool rebalancing is frequent: When the pool is constantly adjusting its share distribution, some shares might not be properly reflected on the local rig.

- Network congestion persists: Persistent network congestion can lead to delays in verifying blocks and reporting shares.

Solutions and Workarounds

To minimize this discrepancy:

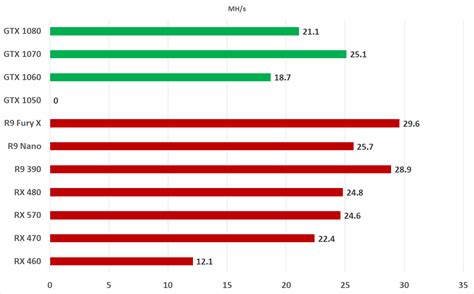

- Use a reliable mining hardware: Choose a mining rig with fast verification times to reduce the likelihood of congestion and verification delays.

- Monitor pool rebalancing

: Keep an eye on your pool’s share distribution to ensure it’s being adjusted correctly.

- Configure advanced mining settings

: Some mining software allows you to adjust configuration options, such as block time or verification timeout, to optimize performance and reduce network congestion.

Conclusion

While the issue of mismatched share counts can be frustrating, it’s not necessarily a sign of a problem with your local rig or pool. By understanding the factors contributing to this discrepancy and implementing strategies to mitigate them, you can minimize the impact on your Ethereum mining experience.