Technical Valuation, TRC-20, Market Correlation

Uncovering the Secrets of Cryptocurrency Markets: A Deep Dive into Cryptocurrencies, Technical Valuation, TRC-20, and Market Correlation

The world of cryptocurrencies has seen tremendous growth over the past decade, with their value skyrocketing from a few hundred dollars to hundreds of thousands in just a few years. However, as market volatility and complexity have increased, so has the need for sophisticated tools and methodologies to understand and navigate these markets.

In this article, we will delve deeper into the world of cryptocurrency trading, exploring three main areas: cryptocurrency technical valuation, TRC-20 (Tokenized Real Estate), and market correlation. We will also examine how these concepts are interconnected, providing a deeper understanding of the intricate relationships that drive the cryptocurrency market.

Cryptocurrency Technical Valuation

Technical valuation is a crucial aspect of cryptocurrency investing. It involves analyzing various metrics and indicators to determine whether a particular asset has increased or decreased in value over time. Some important technical factors include:

- Rapid price growth: If an asset’s price is increasing at an alarming rate, it may be due for a correction.

- Relative Strength Index (RSI): A measure of market momentum, the RSI helps identify overbought and oversold conditions.

- Moving Averages

: A lagging indicator that measures the overall trend, helping investors assess the direction of the asset.

A thorough technical analysis can reveal hidden patterns and trends in the market, allowing investors to make informed decisions. However, it is essential to remember that technical indicators are not a substitute for fundamental analysis. Investors should consider other factors such as market sentiment, economic data, and news events when making investment decisions.

TRC-20 (Tokenized Real Estate)

In recent years, the TRC-20 has gained significant attention in the cryptocurrency space. Tokenized real estate refers to the process of converting traditional assets into digital tokens, enabling a more efficient and transparent way to invest. Some key features of TRC-20 include:

- Decentralized Finance (DeFi): TRC-20 is often used as collateral or an investment vehicle in DeFi applications.

- Tokenization

: The process of creating digital tokens from real-world assets, such as property deeds or stocks.

- Blockchain-based platforms: Platforms such as Compound and Aave allow for the creation and trading of TRC-20s.

The potential benefits of TRC-20 are numerous. It offers a more accessible way for individuals to invest in real estate without the need for direct ownership. Additionally, TRC-20 can be used as collateral for loans or other financial instruments, expanding its use cases beyond traditional DeFi applications.

Market Correlation

Market correlation refers to the tendency of different assets to move together. In a bull market, all assets tend to rise in unison, while in a bear market, they often decline simultaneously. Understanding market correlation is essential for investors looking to minimize risk and maximize returns.

Some key market correlation factors include:

- Global Economic Indicators: Macroeconomic data such as GDP growth, inflation rates, and interest rates can impact asset prices.

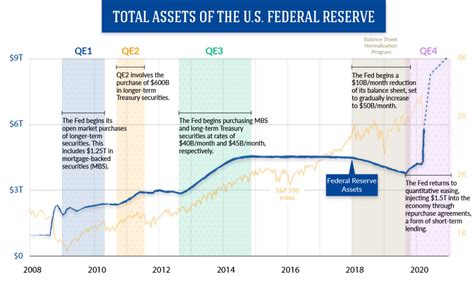

- Central Bank Actions: Central bank interventions or changes in monetary policy can influence asset markets.

- Economic Trends: Emerging trends in areas such as technology, healthcare, and sustainability can impact multiple asset classes.

By analyzing market correlations, investors can gain insight into potential trends and make more informed decisions. However, it is crucial to remember that correlation is not an exact science. Even small changes in an asset’s price can have a ripple effect on the broader market.

Leave a Reply

Want to join the discussion?Feel free to contribute!