How AI Enhances Transparency in Cryptocurrency Transactions

How AI is improving transparency in cryptocurrency transactions

The world of cryptocurrency transactions is rapidly evolving, with new technologies and innovations emerging to improve security, efficiency, and transparency. Artificial intelligence (AI) plays a significant role in improving the transparency aspect of these transactions. In this article, we will explore how AI is improving transparency in cryptocurrency transactions.

What is transparency in cryptocurrency transactions?

Transparency refers to the ability of users to understand their financial activities, including the flow of funds and transactions. In the context of cryptocurrency, transparency is essential to building trust between buyers and sellers, as well as ensuring compliance with regulatory requirements. In traditional banking systems, transaction transparency was typically limited to reporting information to regulators.

How AI Improves Transparency in Cryptocurrency Transactions

AI has made great strides in improving the transparency aspect of cryptocurrency transactions through several mechanisms:

- Blockchain Analytics: AI-based blockchain analytics tools can monitor and analyze blockchain data in real time, providing insights into transaction patterns, wallet usage, and network congestion. These tools help identify suspicious activity and detect potential security threats.

- Transaction Monitoring: AI-based systems can constantly monitor transactions on the blockchain, flagging unusual or suspicious behavior that could indicate a security breach or other malicious activity.

- Smart Contract Auditing: AI-based auditing tools can inspect smart contracts to ensure they are executing correctly, detecting errors and inconsistencies in the code.

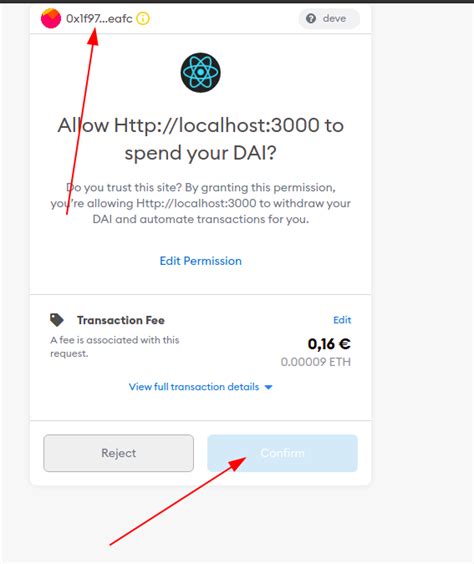

- Wallet Transparency: Wallets like MetaMask and Ledger offer built-in transparency features, such as the ability to see which transactions have been executed on your wallet and when they occurred.

Benefits of AI-Powered Transparency

The benefits of AI-powered transparency in cryptocurrency transactions are numerous:

- Enhanced Security: By monitoring transactions in real time, AI-powered systems can detect potential security threats and prevent malicious activity.

- Improved Compliance: AI-powered auditing tools help ensure that transactions comply with regulatory requirements, reducing the risk of fines or penalties.

- Enhanced Trust: Transparent transactions increase trust between buyers and sellers, promoting a safer and more stable cryptocurrency market.

- Improved User Experience

: By providing real-time information about transaction activity, users can make informed decisions and avoid potential problems.

Challenges and Future Directions

While AI-powered transparency has many benefits, there are also challenges to address:

- Data Quality: The accuracy of AI-powered systems depends on the quality of the data used to train them. Ensuring the trustworthiness of blockchain data is a significant challenge.

- Regulatory Compliance: As regulations evolve, it is essential to ensure that AI-powered transparency systems comply with evolving regulatory requirements.

- Scalability

: AI-powered systems require scalable infrastructure to handle the large volumes of transactions and data generated by cryptocurrency markets.

Conclusion

AI has revolutionized the world of cryptocurrency transactions, improving transparency and security in a rapidly evolving market. As regulations evolve, it is essential to ensure that AI-powered transparency systems are designed with regulatory compliance in mind. By leveraging AI-powered tools, financial institutions can build trust, improve user experience, and maintain a safe and stable cryptocurrency market.